From Data Lake to Financial Return: Unlocking AI Value in Portfolio Companies

By GAPx

We work with private equity firms and portfolio company operators who are tired of the delta between AI ambition and operational reality. Here’s the truth: most companies already have the ingredients for AI success (data, infrastructure, talent) but they’re stuck in neutral. Why? Because they built data lakes and stopped there.

The value isn’t just in the lake, it’s in how you use it.

PE Isn’t Waiting for Pilots Anymore

Private equity has always been about turning inefficiency into value. AI is just the next tool in that arsenal. What’s changed is the level of scrutiny. It’s no longer acceptable to point to a data warehouse and say, “We’re AI-ready.” Investors want to know what’s actually working and how it scales.

McKinsey reports that PE firms deploying AI and tech across investment, operations, and risk can achieve 10x ROI across the asset lifecycle (McKinsey, 2023). A separate HBR analysis shows that firms are now embedding AI into their value creation plans as early as due diligence (HBR, 2025). This isn’t about future-proofing. It’s about immediate operational leverage.

Why Most Data Lakes Are Still Swamps

We regularly see portfolio companies with the right cloud infrastructure, the right dashboards, and the right intentions, but no velocity. Why?

Data is poorly catalogued or siloed across functions.

Analysts spend 80% of their time cleaning, not analysing.

Governance is either non-existent or bolted on post hoc.

Most business units aren’t even aware of what data exists.

According to Harvard Business Review, just 10% of organisations feel fully ready for AI adoption, and over half say their data isn’t reliable enough to support automation or modelling (HBR/Profisee, 2023). This isn’t a technical problem. It’s an organisational one.

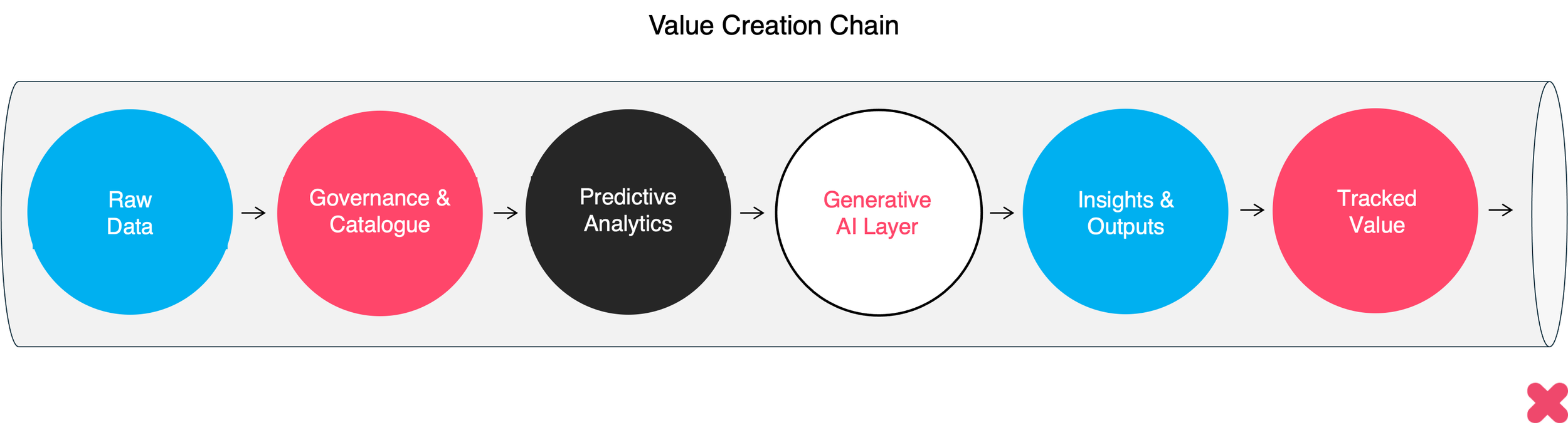

From Raw Data to Decision Power

AI readiness isn’t about having the latest model. It’s about whether you can take data and turn it into business decisions. That requires orchestration across people, platforms, and process.

We recommend a shift in posture:

From dashboards to decisions. Your Power BI or Tableau charts mean nothing if they don’t improve margin, forecast accuracy, or customer retention.

From data lake to data product. Treat your data assets like products (versioned, maintained, owned, and used).

From sandbox to workflow. AI shouldn’t be an R&D artefact. It should live where the work gets done: pricing engines, underwriting, logistics and marketing ops.

Top-performing companies treat genAI and predictive AI as complementary layers - forecasting demand with structured data, then using LLMs to generate personalised outputs or operational responses. McKinsey calls this “rewiring the enterprise”, and it’s how firms are capturing real EBITDA gains (McKinsey, 2025).

What AI Value Actually Looks Like

Forget the hype cycles. Most AI value creation is practical, measurable, and often unsexy.

A portfolio company automates customer triage and reduces resolution time by 40%.

A forecasting model increases demand accuracy by 12%, lowering excess inventory.

GenAI auto-generates draft responses to RFPs, shaving days off sales cycles.

These aren’t fantasies. They’re workflow accelerators. And they work because they’re embedded into how people already operate and not imposed on top.

According to PwC, the highest-performing portfolios are prioritising “value-linked” use cases early (churn modelling, pricing elasticity, cash flow prediction) before scaling more creative applications (PwC, 2024).

From Data to Performance

We use a five-stage model that moves companies from “we have the data” to “we're driving results.”

1. Audit and Baseline

Start with a readiness diagnostic: data quality, governance maturity, tech stack, C-suite alignment.

2. Governance and Ownership

Define who owns the data. Not just technically, but strategically. Set up cross-functional councils to manage data as a living product.

3. Use Case Prioritisation

Don’t chase cool demos. Prioritise where AI intersects with P&L, forecasting, pricing, retention, procurement.

4. Workflow Integration

Pilot in the flow of work. Tools should support users, not add new layers of friction.

5. Track, Measure, Scale

Monitor uplift, precision, and engagement. Then scale what works, across brands, markets, or business units.

This is not an AI strategy. It’s a business strategy enabled by data.

PE Investors Are Asking Better Questions

We’re seeing a shift in due diligence conversations. It’s no longer “do you have AI plans?” It’s:

What’s your data catalogue maturity?

Which use cases are in production?

How do insights flow into operational decisions?

What’s your cost to serve vs. AI-driven optimisation

LPs are also getting impatient. European investors now expect measurable AI returns by 2026, —or they’ll reallocate capital elsewhere (Reuters, 2025). There’s real pressure on operators to turn capability into commercial advantage.

GAPx: Why This Matters Now

We don’t push AI for AI’s sake. We work with clients to build control layers - clean, governed, AI-ready data systems that link strategy to execution. That’s how you turn potential into performance.

If you’re sitting on a data lake that’s delivering reports but not returns, the issue isn’t capacity. It’s orchestration. You don’t need another model. You need a new approach.

If you’re a PE investor or portfolio operator, the window to demonstrate AI impact is now. Not theoretical readiness. Not a Centre of Excellence with a backlog of prototypes. Actual results.

At GAPx, we help companies get there. We make AI useful by making data usable.

Let’s turn your lake into leverage.

If you would like to read deeper on this subject, check our recent white paper below.