White Paper: Unlocking AI Value in Private Equity

1. Introduction: AI as a Strategic Imperative

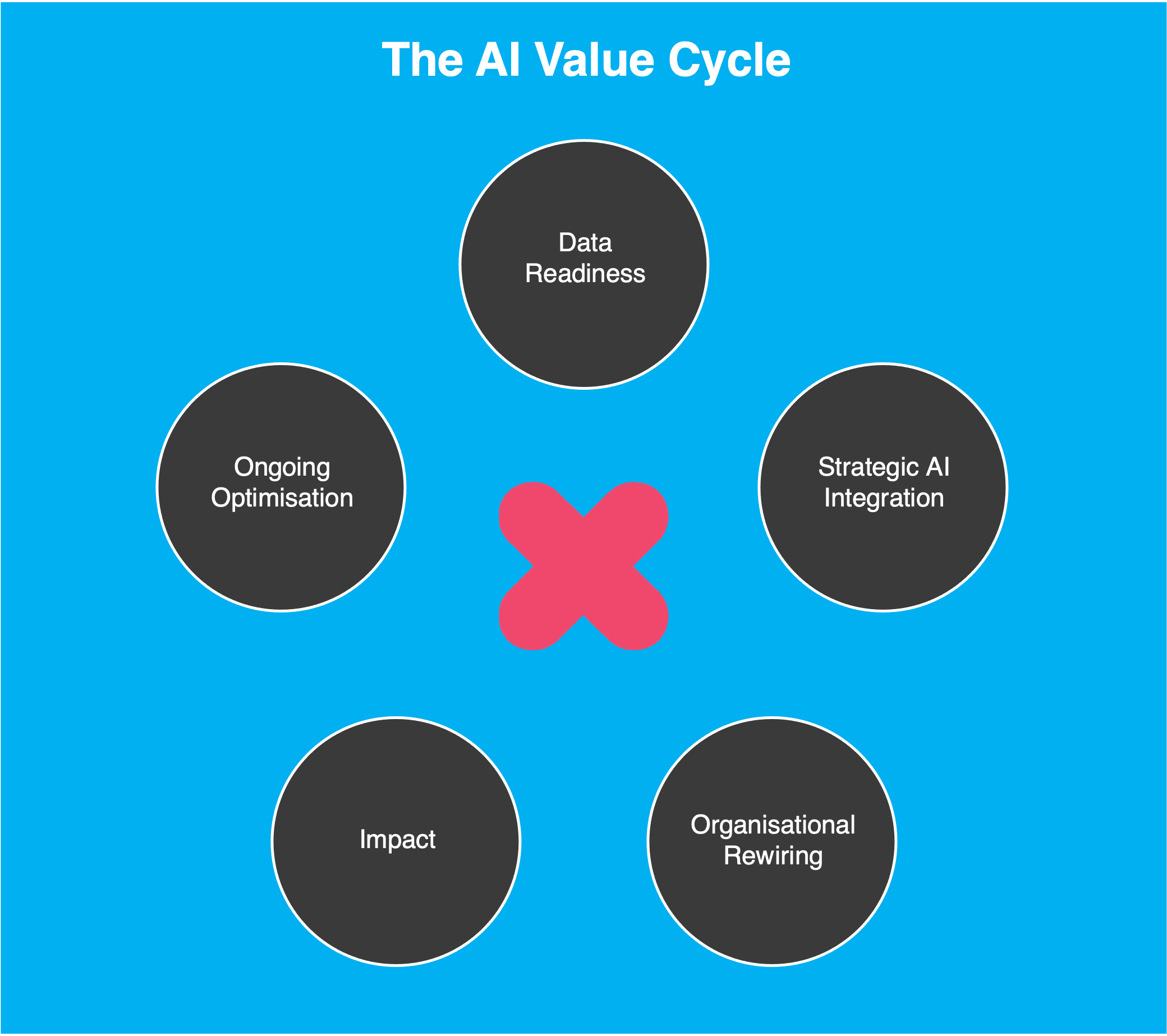

Private equity (PE) uniquely stands at a strategic crossroads, with AI presenting an unparalleled opportunity to revolutionise portfolio companies and deliver accelerated value creation. The imperative arises from escalating investor expectations, competitive pressures, and a rapidly evolving technological landscape. European investors, in particular, have articulated a clear urgency for tangible AI outcomes. Industry-leading analyses from McKinsey and Reuters underscore that AI is no longer a speculative venture but a competitive necessity. The crux is not merely technology adoption but the swift and strategic implementation of sophisticated analytics to drive measurable business outcomes.

2. Data Readiness as Your Strategic Advantage

Data readiness is foundational for any successful AI-driven transformation. It is more than a checklist; it's an organisational capability enabling strategic decisions. According to Harvard Business Review, data readiness encompasses three critical dimensions: robust data governance, impeccable data quality, and a pervasive data-driven organisational culture. Robust governance ensures data integrity and compliance, while data quality facilitates precise and trustworthy analytics. An organisation-wide culture of data literacy ensures continuous improvement and agility. PE firms proficient in these pillars can swiftly move from mere data accumulation to actionable insights and AI-driven strategies, positioning them significantly ahead of competitors who lag in these essential capabilities.

3. AI Integration Isn't Optional; It's Essential

Strategic integration of AI involves aligning advanced analytics initiatives closely with the core business objectives of PE firms and their portfolio companies. PwC and HBR emphasise that AI integration is not merely technological but inherently strategic and outcome-driven. Successful PE firms carefully calibrate their AI initiatives, balancing innovation, risk management, and measurable business outcomes. AI applications such as advanced due diligence using generative AI, risk assessment optimisation, and operational efficiencies exemplify how thoughtfully integrated AI initiatives lead directly to improved valuations, reduced risks, and accelerated returns. PE firms that approach AI adoption methodically, strategically aligning technology investments with specific business needs, consistently achieve superior financial outcomes.

4. Rewiring Your Organisation for AI

Organisational rewiring is essential for embedding AI within PE operations, fundamentally reshaping organisational structures, processes, and culture. McKinsey’s 2025 State of AI report clearly indicates the transformative success achieved when organisations embed AI capabilities throughout their operations, from executive leadership down to frontline employees. Such rewiring involves extensive training, transparent communication, updated governance structures, and an agile approach to adopting new processes. Concrete examples across industries demonstrate substantial gains in efficiency, responsiveness, and market competitiveness once AI becomes integral to daily workflows, rather than an isolated technological initiative. For PE firms, rewiring means constructing AI-savvy leadership, promoting interdisciplinary collaboration, and fostering a proactive data-driven organisational culture.

5. AI Done Right: Real-world Examples

Concrete examples vividly illustrate the tangible benefits of strategic AI deployment within private equity contexts:

Predictive analytics utilised for operational optimisation led to productivity improvements exceeding 20%, highlighting the direct financial benefit achievable from operational efficiencies.

Advanced generative AI tools enhanced due diligence processes, delivering deeper, more insightful evaluations, substantially mitigating investment risks and driving smarter acquisition decisions.

AI-driven forecasting tools significantly clarified sales and growth trajectories, allowing more precise financial planning and strategy execution, directly accelerating portfolio company growth and valuations.

These real-world examples underscore that AI, strategically deployed, provides far more than theoretical advantages—it generates concrete financial returns and lasting operational excellence.

6. Navigating Pitfalls with Precision

The path to AI-driven value creation is not without challenges: data silos, fragmented implementations, talent scarcity, and cultural resistance are formidable barriers. Yet each is navigable with strategic precision. Successful PE firms systematically tackle these issues by integrating cross-functional AI and data teams, fostering a culture of transparency and collaboration, strategically investing in talent acquisition and development, and ensuring AI initiatives align with clearly defined and measurable business objectives. Precise, deliberate actions in these areas not only mitigate common pitfalls but transform them into areas of competitive strength.

7. Moving Forward: Concrete Steps to Capture AI Value

Actionable next steps provide a clear path forward:

Conduct a thorough evaluation of current data readiness and maturity relative to industry benchmarks.

Identify targeted, high-impact AI use cases explicitly linked to business outcomes and financial performance targets.

Form cross-functional teams dedicated to AI initiative implementation, ensuring alignment with strategic goals and operational effectiveness.

Continuously track, measure, and refine AI-driven initiatives to optimise impact, scalability, and sustained value creation.

By following these pragmatic steps, PE firms and their portfolio companies can decisively harness AI’s full potential, securing competitive advantages, achieving superior returns, and positioning themselves as pioneers in the evolving landscape of digital and technological innovation.

Bibliography:

Harvard Business Review. (2025). "Data Readiness for the AI Revolution." Retrieved from https://profisee.com/harvard-business-review-data-readiness-for-the-ai-revolution/

McKinsey & Company. (2025). "Unlocking Value from Technology and AI for Institutional Investors." Retrieved from https://www.mckinsey.com/industries/private-capital/our-insights/unlocking-value-from-technology-and-ai-for-institutional-investors

McKinsey & Company. (2025). "The State of AI: How Organisations Are Rewiring to Capture Value." Retrieved from https://www.mckinsey.com/~/media/mckinsey/business%20functions/quantumblack/our%20insights/the%20state%20of%20ai/2025/the-state-of-ai-how-organizations-are-rewiring-to-capture-value_final.pdf

PwC. (2025). "Generative AI Strategy for Private Equity Portfolio Companies." Retrieved from https://www.pwc.com/us/en/tech-effect/ai-analytics/generative-ai-strategy-for-private-equity-portfolio-companies.html

Reuters. (2025). "European Investors Say Clock is Ticking for AI Adopters to Deliver." Retrieved from https://www.reuters.com/markets/europe/european-investors-say-clock-is-ticking-ai-adopters-deliver-2025-03-26/